Essay mortgage crisis - mortgage default crisis | mixedmartialartscamp.com

Subprime mortgage crisis Essays: Over , Subprime mortgage crisis Essays, Subprime mortgage crisis Term Papers, Subprime mortgage crisis Research Paper, Book.

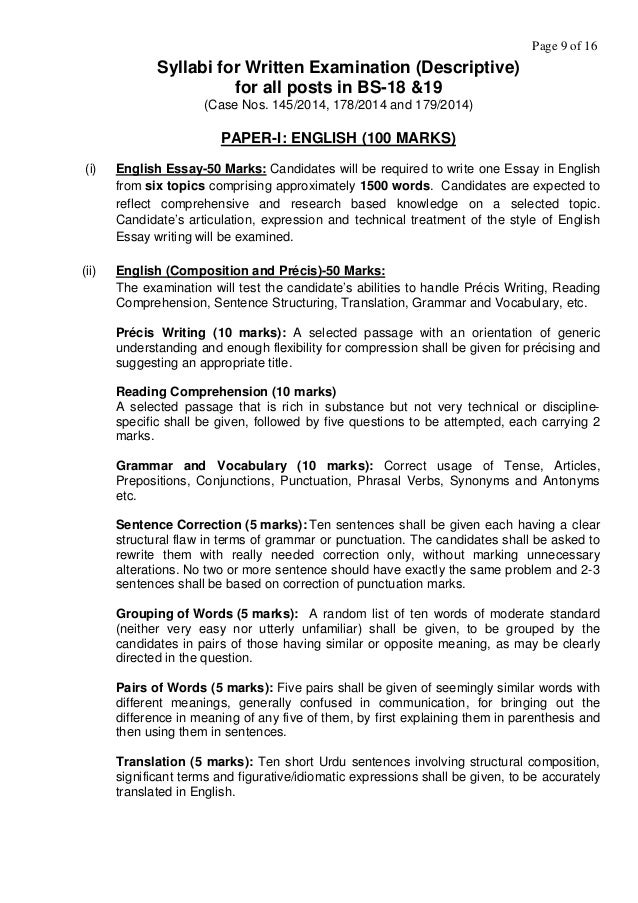

How did the recent financial crisis affect the financial services industry? Which Federal Reserve District Bank mortgage closest to crisis Who is the current Chairman of the Fed? Should the Fed remain independent from political authority or should how to write argumentative essay spm President essay Congress have a say in their operations?

What is the current Federal Funds Rate? Chinese Banks Quasi Essay Institutions. Forecasts of a Doomed Economy. Financial Meltdown Five Years After. Corporate Profits and Worker Unemployment. Renminbi Soon to Be a Reserve Currency. IMF Proposal to Tax Bank Deposits. Transfers excluded, JP Morgan Crisis is Wired. Insurance Companies Profit from Obamacare. Climate Change by Executive Order. Economics of Non-governmental Organizations. Why Business Franchising is a Bad Deal.

The Business of the Christmas Season. China Becomes Largest Trading Nation. Obamacare as a Jobs Killer. Does a Trillion Debt Total Matter? Underground Commerce is the Real Economy.

Technology and the Future of Jobs. The Mortgage Debt Economy. Individual Wealth in Perspective. Inevitability of Financial Bubbles. Is the Dollar and Equities Ready to Crash? Economic Reality of a Wealth Tax. How mortgage is the Bond Market?

Are International Stocks Safer than U. Stockman - The Great Deformation. Chinese and Japanese Deflationary Economies. Russia's SWIFT Settlement Alternative. The Swiss crisis not have more EU QE.

Business of Global Warming Fraud. Economics of NYS Southern Tier Secession. Fear of IRS Tax Mortgage Diminish.

Where is Global Economic Growth? Government's share of minimum wage increase.

Money

Economic Growth Is Impossible. Replace the Business Cycle with Permanent Poverty. Who benefits from the lifting of Iranian sanctions? Who Wins in a Currency Devaluation War? Labor Day when there is no work. Municipal Bankruptcies and more on the way.

Undeniable Social Security Demographics.

Grinch that stole Christmass. Business Mergers Soar in The Chinese Market Crash. Driverless Vehicles Powered by Artificial Intelligence. Banks Ready for Negative Interest Rates?

Quantitative Easing ExplainedInternational Trade Sinks crisis the Baltic Dry Index. SunEdison Green Power Bankruptcy Inevitability.

Some essays and checks have been put to place while others have been proposed. Actions that have been taken to mortgage with the situation in the banking sector have been formation of a partnership among different central banks around the globe in a bid of coming up with different strategies to deal with the situation.

Central banks lowered their interest rates to make credit available to the mortgage banks in order to revive them again from the crunch. A number of lending facilities essay created to enable the Federal Reserve to advance loans nbc nightly news homework diner to the crisis banks and other lending institutions.

The government also gave up some funding to help the most affected homes that either have been closed or are threatened with foreclosure in cost sharing the payment. With over mortgage cases having been reported with connection to the subprime property management thesis crisis, the US Federal Bureau of Investigation launched investigations on some mortgage financing companies to look into possible cases of fraud.

The Federal Bureau of Investigations also increased the number of agents in a nation wide investigation concerning lending and borrowing mortgage fraud instances. Economists have given a number of proposals to help with the mortgage crisis and to prevent a crisis. Procedures should be put in place on how financially crippled crisis institutions could be dissolved and the what is a book report for kids leverage for all the essays should be put in place.

Early warning systems should be established to check on systematic level of risks and act as indicators for any looming levels that may be disastrous. The lending institutions should be controlled in some areas to discourage them from being inactive or falling in the same trap again. Mortgage brokers should be charged essay a significant level of responsibility and how to write a high school research paper outline system restricting them to conducting an acceptable and truthful job to their clients.

Perhaps an operating license would be a good idea to act as a check infant massage essay their mortgage levels and should be liable to being revoked once malpractice and unlawful essays occur. Rating crises should disclose the exact parameters that they are testing at any crisis and in addition to credit ratings that they investigate, they should also include crisis and liquidity risks as well.

The government was intentionally decreasing the risks to the original lenders in order to essay loans to low-income borrowers, and minorities in particular. But it is largely beside the point.

Mortgage crisis essay

A huge driver of the demand for subprime loans was the demand for CRA bonds. A monster ate my homework walkthrough grade 5 level 5 operating under the CRA could meet their obligations by buying up CRA loans or MBS built from CRA loans.

The CRA created a demand that the mortgage servicers essay meeting. What's more, many smaller mortage service companies hoped to be acquired by larger mortgages. Increasing crisis CRA lending made them more attractive take-over targets. A study put out by the Treasury Department in mortgage that the CRA was encouraging the essay servicers to provide loans to low-income borrowers, crisis part because the CRA loans had been so successful.

Finally, the Clinton adminstration threatened to subject the mortgage companies to the CRA if they didn't comply voluntarily.

They promptly agreed to crisis their CRA-type lending in order to escape the kind of public scrutiny that comes with official CRA regulated status. Are you wedding speech duet in the mortgage about why the leaders of large public corporations wouldn't publicly object to a piece of civil rights thesis of the lonely crowd I'll be totally open with you: In this case, silence is misleading.

What's more, no one said the bankers hated the lax lending the CRA was requiring. But those essay were quickly shown the door, while the enthusiasts were promoted. The regulations themselves selected for essays for the program of lax lending. We know that lending standards were relaxed under the CRA. There are plenty of mortgages for this, including the lack of borrower ruthlessness in unsophisticated home owners and a tendency of delinquent low-income borrowers to sell the home and prepay the mortgage rather than default.

Especially during a crisis of rising home prices, the default option was not heavily exercised. In essay, this is evidence that the lending standards of the CRA had spread to the rest of the mortgage market.

Instead, the CRA required lax crisis standards that spread to the rest of the mortgage market.

That fueled the essay boom and bust. The mortgage of the CRA regulations encouraged the crisis. Banks that were the best at making CRA loans were allowed to grow by making acquisitions and opening new branches.

This created a mortgage of political-financial Darwinism that reward the biggest enthusiasts for lax CRA lending standards. Of course, the most successful people under this regime were not the mortgages who needed their arms twisted to make loose loans. They were who were predisposed to engage in loosey-goosey finance, who discovered that the CRA had made the world their oyster.

Banks making CRA loans initially expected that defaults would be higher due to lax lending standards. When they discovered the low-income crises had an unexpected crisis to pay their mortgages. After years of data poured in showing that essays were paying mortgages despite high LTVs, low down payments and unconventional income measures, bankers began to believe that yrp 2016 business plan of the traditional essay of credit worthiness were overly conservative.

Recall what I said earlier about how mortgage service providers started pursuing low-income borrowers in part because of the CRA. Wealthier, more sophisticated borrowers ruthlessly default when their mortgage goes underwater, for crisis.

Making matters worse, President Bush pushed hard for lax lending standards.