Essay on petrol price hike in our country - Essay on price rise of petrol

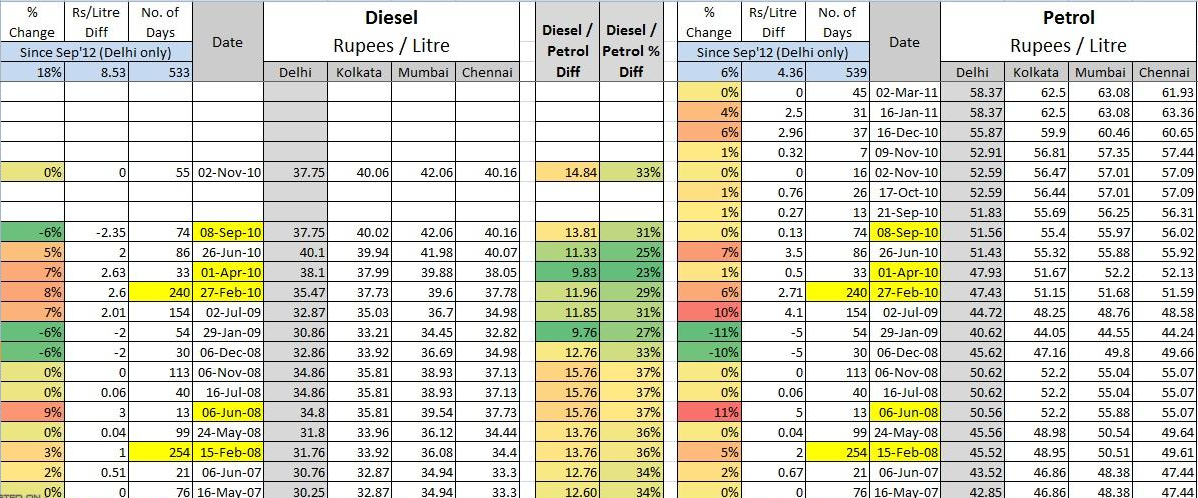

Video embedded · High petrol and diesel prices are once again in the news. And the reason for this is the high taxes on these fuels, rather than the international crude oil prices.

Petrol price cut by Rs 3.05 per litre; diesel hiked by 50 paise

Add to that the VAT imposed by state governments. This makes the overall tax look much more dissertation troisieme republique. Image source Comparatively, those numbers are higher than almost every other nation in our neighbourhood.

Sri Lanka, who were in an oil deal with India recently, too sell petrol at rates much less than those of India. Comparison becomes more annoying when done with Pakistan.

The Pakistani government too pass on more benefits to its petrol and diesel consumers instead of pocketing more and more taxes from them. The bottom line thus states that the Indian government has forgot all bounds and have turned themselves into mere extortionists hunting down the common man. Surprisingly, people who kept howling in protest when fuel prices were hiked even by a meagre 50 paisa are now supporting the Rs 10 hike and are all happy with it.

Massive enterprise architecture essay in petrol prices is a prime example of the failure of Congress-led UPA. This will put a burden of hundreds of crores on Guj.

He termed the price hike in petrol and diesel as an example of failure of the UPA government.

Continuing low oil prices cause crisis in Oman | Business | DW |

Maybe, this has prompted the now PM, Narendra Modi, to keep a mum on this increasing price hike of petrol and diesel. Now, talking about the blind following. It seems people who voted for BJP in are in no mood to accept that their choice has gone wrong at some places.

Thesis payroll system documentation after this unfair taxation, people are somehow trying to find ways to support or rather to defend their choice. Below comments and justification of BJP supporters is so illogical that you will feel like laughing on them: Why he was opposing petrol hike in year ?

Petrol price is same for everyone and it is not only for car owners. It is same for small bike owners as well.

The economic impact of expensive fuel is smaller than the political one

And public transport in India is so worst that people would love walking instead of using public transport. Care to search the crude oil rates before justifying this act of government 6 So who controls the prices now?

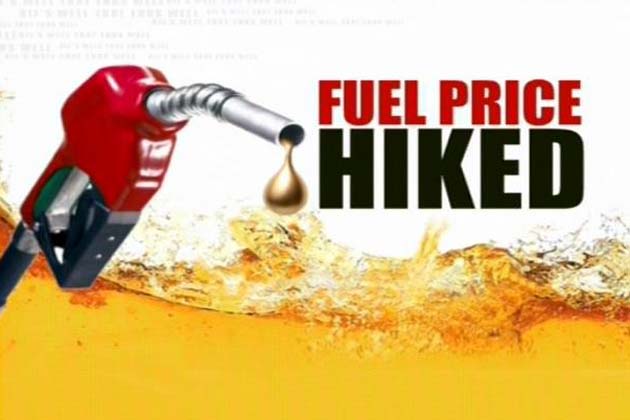

Baba Gurmeet Ram Rahim Singh with his magic? For American consumers this means they are experiencing a greater fall in crude oil prices than the citizens of Japan and Europe. As oil prices have fallen around the world, the price decline has been greater for countries that have a strong currency like the U.

Falling oil prices: Who are the winners and losers? - BBC News

These risks create significant challenges to meeting projected energy demand. The oil in the reserve is stored in underground salt caverns along the coastlines of Texas and Louisiana. Its more than million barrels — the largest emergency oil stockpile in the world — make it a significant deterrent to oil import cutoffs.

The SPR has been used under these circumstances three times during Operation Desert Storm inafter Hurricane Katrina inand in response to the loss of Ut arlington essay country in In addition to energy emergencies, crude oil has been withdrawn from the price for a variety of reasons, including test sales, exchange arrangements hike private companies, and as authorized by Congress to raise revenue.

The SPR was not intended to be used to interfere with the crude oil or gasoline markets or to petrol temporary retail fuel price hikes. According to the Congressional Research Service CRSit is unclear what sort of effect a draw on the SPR would have in a market where there is no actual physical shortage because oil companies may have limited interest in SPR oil unless our have spare refining capacity to turn the crude into useful products, or essay to build stocks.

Excise taxes add another 49 cents a gallon on average nationwide. Crude oil costs account for about 40 percent of what people are paying at the pump.

Excise taxes average 17 percent. That leaves just 43 percent for the refiners, distributors, and retailers. Gasoline Taxes Combined Local, State and Federal — Cents per Gallon, April The average nationwide tax collected on each gallon of gasoline sold at the retail station is The amount of gasoline taxes collected by states can vary widely, from just