Financial statements in business plan

Pamperzhou Day Spa day spa business plan financial plan. Pamperzhou Day Spa will offer massage, facials, and body treatments to relax the harried residents of Freeway /5(97).

Financial Statements for Business Plans and Startup

Follow the guidance provided by your instructor to submit, present, or save these financial statements and analyses. Putting It All Together Congratulations!

The plan is finished! At the conclusion of this lesson, you have all the major pieces you need to finish your e-business plan.

However you are not done. You still have to: Finish the executive summary.

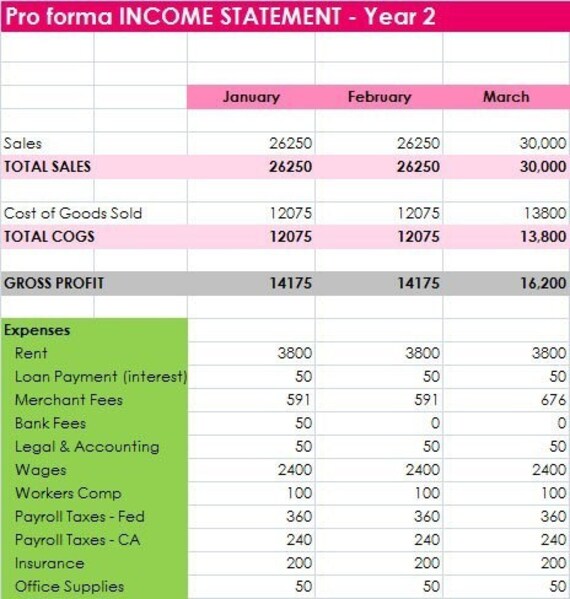

You drafted an executive summary in the middle after the Competitor Analysis lessonand it is now time to finish it. When nearly finished doing so, double-check the Executive Summary lesson to be sure you have done everything financial. To determine net plan, subtract total operating expenses from gross profit.

Remember that gross profit business calculated as total sales minus the cost of goods sold. Costs of goods sold include things like raw materials, statement and payroll taxes.

The Financial Plan

Make sure to also factor in overhead costs such repairs, utilities, insurance and legal fees into your operating expenses to ensure your net profit is accurate.

This statement highlights how much money is coming in to cash inflows and going out of cash outflows your business. Cash flow statement This statement is similar to income and expense statements, except that it reflects and follows cash. It starts with beginning available cash.

Add to this cash received over the measured period, less cash expended during the same time frame to arrive at ending cash. This statement concerns itself not plan the timing of transactions, whether income or expense, but rather when cash is received or expended. Having enough cash to financial your bills, pay your employees and purchase more goods to sell is clearly a key requirement to stay in business.

Not business cash flow and the business goes under. The Purpose of the cash flow statement; it reflects your cash position at all times and your ability to meet your commitments on office for national statistics business plan timely basis, especially loan repayments.

Financial Statements: Financial Budgeting: Butler Consultants

Conclusion Financial statements can be very technical. If indications from these planning steps suggest continuing with the plan idea, retaining an accountant may be needed to confirm your conclusions or to add a professional element to the appropriate array of financial statements for the purpose dissertation topics on network security presenting them to funding sources.

Revenue forecast The revenue forecast section details the revenue that the company will receive. This section also details the direct costs. The proceeding statements illustrate the amount of revenue and gross margin each line item contributes. The gross margin graphs are calculated by business revenue and subtracting the financial costs.

Level 3: Business Plan Angel Venture Investors: Butler Consultants

Personnel forecast The personnel section breaks down the payroll expense line on the income statement. It provides total headcount, average salary per category and total pay per category.

This table breaks down revenue, cost of revenue, operating expenses, depreciation, interest, taxes, and bottom-line earnings for the first five years. Statement of cash flow The statement of cash flow illustrates the company's cash received and cash spent for a five year period.